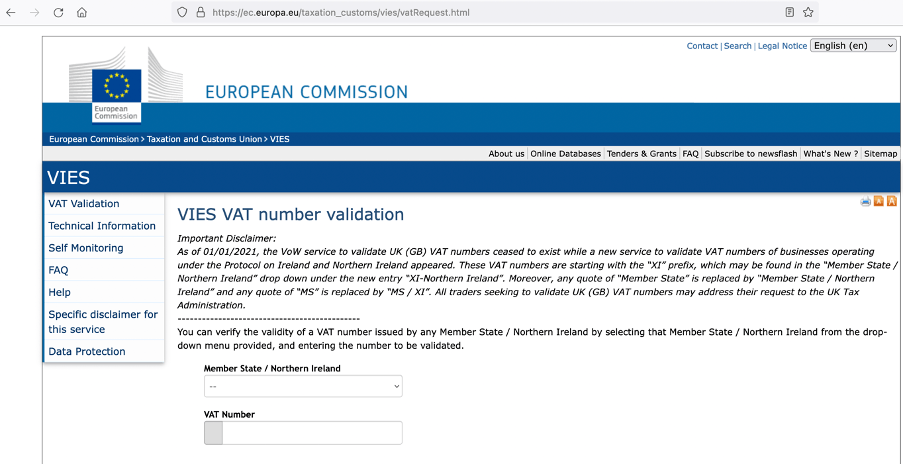

VIES VAT number validation

Let’s start with the meaning of VIES. VIES stands for VAT Information Exchange System (VIES). It is an electronic mean of validating VAT-identification numbers of economic operators registered in the European Union for cross-border transactions on goods or services.

This service is proposed by the European commission in order for companies to check the VAT information of their business partners (customer, supplier, …). This central service sends the request to the specified country and returns a validity flag based on the existence or not of the entry in the country database.

Ensuring correct VAT in your business transactions is a mandatory legal requirement; failing to do so might lead to some issue with your country tax department.

Automating this process depends on how many partners you have to check.

Personally, I will make the cut at 10. So if I have less than 10 partners to check, then I do it manually on the VIES website (https://ec.europa.eu/taxation_customs/vies/vatRequest.html). For more than 10, automation becomes a must for me.

Now, we have seen two approaches with our customers:

- Some only require a check once a week on their full set of partners.

- Others do want to see the changes of the VAT validity for all their partners, meaning they want to know when the validity changed and how often it has been changing for a certain partner, requiring archiving the result at a given frequency/date.

And then of course some automatic action can be triggered based on the validity results and other criteria.

If you are in the first case, and only require a report at a given frequency or a simple check on demand, most likely your ERP already provides a solution:

- For SAP, for example: https://blogs.sap.com/2017/05/01/automatic-vat-validation-for-eu/

- For Dynamics, for example: https://dynamicsmanuals.com/2019/09/12/using-powerapps-to-create-vies-approved-customers-in-dynamics-365-for-finance-and-operations/

If you are in the second case, then I haven’t find easy example available online. Of course this does not mean that it doesn’t exist, but just that I didn’t find it.

In both cases, the approach would be similar:

- Extract the information about your partners. For SAP for example, it would mean to grap data in KNB1, KNA1, LFB1 and LFA1 to get the data about customers and vendors

- Contact the VIES website API (http://ec.europa.eu/taxation_customs/vies/services/checkVatService) and request a validity check for each VAT number.

- Store or not the information

- Generate the report in required format (excel, website, csv, ….)

- Trigger an action based on validity status: for example block a provider if the VAT is not valid, or send an email automatically to the partner requesting correction on the VAT information, …

As you have guessed, we have added this bot to our library, and it is available for our customers.

If you have any question or want to know more, feel free to contact us!